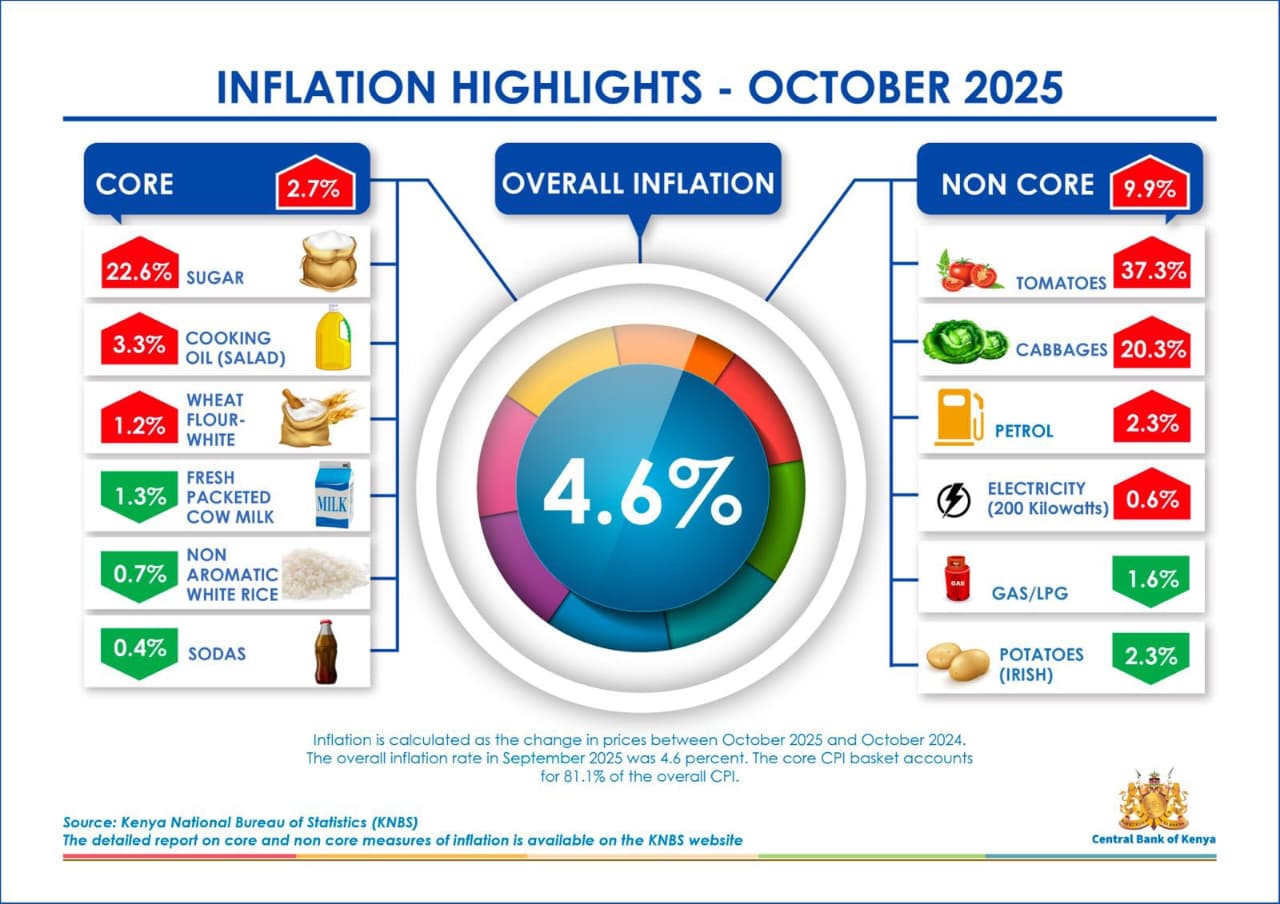

Kenya Inflation October 2025: Household Strain Amid Rising Food and Fuel Costs

Kenya’s inflation in October 2025 remained steady at 4.6% according to the Kenya National Bureau of Statistics (KNBS), yet beneath the headline figure lies a complex story of pressure on households. While headline inflation shows stability compared to September, essential goods such as food and energy continue to climb, forcing millions of families to adjust their budgets and lifestyle choices. The October report underscores Kenya’s economic tightrope — balancing price stability with persistent cost-of-living challenges.

The Central Bank of Kenya (CBK) has succeeded in keeping inflation within its target range, but the split between core and non-core inflation reveals vulnerabilities. Core inflation, which excludes volatile items like food and fuel, remained at 2.7%, whereas non-core inflation, driven largely by energy and food prices, surged to 9.9%. This divergence indicates structural weaknesses in Kenya’s economic system and highlights the country’s dependence on climate-sensitive agriculture and imported goods, both of which are highly susceptible to global price shocks.

Essential commodities experienced notable price increases. Sugar recorded a steep 22.6% rise, cooking oil increased by 3.3%, and wheat flour rose 1.2%. Fresh milk went up by 1.3%, while rice and soft drinks saw smaller gains of 0.7% and 0.4%, respectively. Individually, these numbers may seem manageable, but collectively they have a significant impact on household budgets, especially for low- and middle-income families.

Non-core inflation’s 9.9% rate highlights continued pressure on households and the broader economy. Fresh vegetables experienced dramatic hikes — tomatoes up 37.3% and cabbages up 20.3% — primarily due to erratic rainfall, poor harvests, and increased transportation costs from rising fuel prices. Urban families are particularly affected, as these items take a large portion of household income, leaving little for other essential needs.

Energy costs also contributed to inflation pressures. Petrol prices increased 2.3%, gas and LPG rose 1.6%, and electricity costs climbed 0.6%. Potatoes, a staple in many Kenyan households, increased by 2.3%. These increases illustrate how even moderate fuel and food price changes can ripple across the economy, impacting households and businesses alike.

Urban households are adopting coping strategies, including reducing food portions, buying cheaper alternatives, and cutting discretionary spending. In rural areas, farmers face rising input costs such as fuel and fertilizer, squeezing profit margins. Small businesses, particularly in the hospitality and food sectors, have been forced to adjust prices or reduce portions to remain viable, often passing some of the burden onto consumers.

The government faces a challenging policy environment. Short-term measures include stabilizing fuel prices, supporting local food production, and providing targeted subsidies to vulnerable households. Strengthening food storage infrastructure and investing in irrigation systems could mitigate seasonal shortages. Long-term strategies should focus on reducing dependency on imported commodities such as sugar, wheat, and edible oil, thereby increasing resilience against global price fluctuations.

The CBK is expected to maintain its current monetary stance, as headline inflation remains within target ranges. However, without structural reforms, persistent non-core inflation may undermine long-term economic growth. Investing in local production, improving transportation networks, and stabilizing energy prices are essential to protecting households and small businesses from continued cost pressures.

Looking ahead to 2026, inflation trends will hinge on rainfall performance, the exchange rate, and global fuel prices. Adequate short rains could boost food supply and ease non-core inflation, whereas rising fuel costs or a weakening shilling could sustain economic pressures. The October 2025 figures illustrate a dual reality: relief from headline stability but continued vulnerability at the household level.

In conclusion, Kenya inflation in October 2025 remained at 4.6%, but headline stability does not equate to relief for households. Rising food and fuel costs continue to squeeze families and small businesses. Coordinated action between government and CBK is crucial to translate inflation control into tangible household relief.

Strengthening domestic production, improving transport infrastructure, and ensuring fair energy pricing will be key steps for Kenya to move from temporary stability to lasting economic security. Monitoring non-core inflation trends and supporting vulnerable sectors remain essential to protecting households from future shocks and achieving sustainable economic growth.

“Headline inflation may appear stable, but rising food and energy costs continue to squeeze households across Kenya.”

This article was prepared by the Ramsey Focus Analysis Desk, based on verified KNBS and CBK data, independent analysis, and insights to ensure balanced coverage.

3 Responses